|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

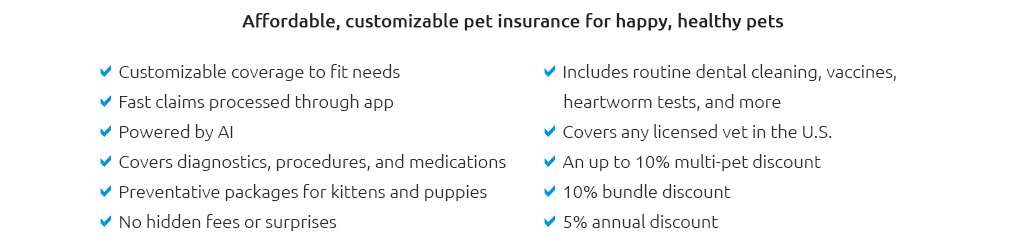

Understanding Renters Insurance with Pet Damage CoverageRenting a home comes with its own set of unique challenges and responsibilities, especially if you're a pet owner. One often overlooked aspect is renters insurance with pet damage coverage. This niche insurance option can be a lifesaver for renters, offering peace of mind and financial protection. But what exactly does it entail, and why should it matter to you? Let’s dive deeper into this topic. Renters insurance, in its most basic form, is designed to protect your personal belongings in the event of unforeseen circumstances like theft, fire, or water damage. However, what many renters might not realize is that standard policies often exclude damages caused by pets. This is where pet damage coverage comes into play. It is an extension or an add-on to your existing policy, specifically designed to cover damages that your furry, feathered, or even scaled friends might cause. Why Consider Pet Damage Coverage? If you’ve ever had a pet, you know that accidents happen. Whether it’s a rambunctious puppy who can’t resist chewing on furniture or a curious cat that knocks over an expensive vase, the potential for damage is real and, sometimes, costly. Landlords may be forgiving to an extent, but significant damages could lead to substantial repair costs or even affect your security deposit. This is where having pet damage coverage can be extremely beneficial. It can cover repair costs and, in some cases, even liability if your pet accidentally injures someone.

When considering renters insurance with pet damage coverage, it’s important to read the fine print. Not all policies are created equal, and coverage can vary significantly between providers. Some may cover only certain types of damage, while others might exclude specific breeds or animal types altogether. It’s crucial to ask questions and understand what is and isn’t covered. Is it worth the extra cost? In my opinion, the answer is a resounding yes for most pet owners. While there is an additional premium for this type of coverage, the potential savings from avoiding hefty out-of-pocket repair costs make it a wise investment. Plus, the peace of mind it provides is invaluable. In conclusion, if you’re a renter with pets, seriously consider adding pet damage coverage to your renters insurance policy. It’s a small price to pay for the added security and peace of mind, ensuring that both you and your beloved pets can enjoy your rented home without the looming fear of accidental damage. Frequently Asked Questions What does renters insurance with pet damage cover? Typically, it covers damages your pet may cause to the rental property, such as scratched floors, chewed furniture, or stained carpets. It may also include liability coverage if your pet injures someone. Does renters insurance cover all pets? Not necessarily. Some policies may have exclusions based on the type or breed of the pet. It's essential to check with your insurer to understand any limitations. How much does pet damage coverage add to my premium? The cost can vary depending on the insurer, the type of pet, and the coverage limits. On average, it could add a small percentage to your existing premium. Can I get renters insurance with pet damage coverage if I have multiple pets? Yes, but you should inform your insurer about all your pets. They will assess the risk and adjust the premium accordingly. Is pet damage coverage worth it? For most pet owners, yes. It provides financial protection and peace of mind against potential damages your pet may cause. https://www.valuepenguin.com/pet-liability-renters-insurance

Most renters insurance policies provide pet liability insurance as part of standard liability insurance. Some pets may be excluded from your ... https://www.moneygeek.com/insurance/renters/pet-liability-renters-coverage/

Renters insurance liability coverage doesn't cover injuries your pet causes to you, or damages it causes to your property or your apartment. https://www.libertymutual.com/property/renters-insurance

Please note, liability coverage comes standard with a Liberty Mutual Renters policy. This means you're protected if you, your family member, or your pet injures ...

|